Your community works hard to maintain and operate a levee to reduce flood risk. However, levees dramatically reduce—but don’t completely eliminate—flood risk. It’s important for the safety of you and your loved ones that you understand the gravity of the remaining flood risk:

- Water could come over the top of the levee if there were more rainfall than the levee was designed to withstand.

- Even regularly maintained and operated levees can fail, letting water rush through.

- Larger rainfall events could also cause flooding from interior drainage issues, where water essentially gets trapped behind the levee.

Think a 0.2% annual chance storm is too rare to occur in your community during your lifetime? Think again! In July 2007, Coffeyville, KS experienced such an event. The City’s accredited levee, which stands at a level 3 feet taller than a 1% annual chance flood, over-topped as the Verdigris River reached a record crest of over 30 feet.

Above: Floodwaters mixed with crude oil from a damaged refinery during the July 2007 Coffeyville flood (courtesy City of Coffeyville).

Flood insurance is the most cost-effective mitigation strategy. Just 1 inch of water can cause $25,000 of damage to your home. However, the average FEMA disaster grant only provides about $5,000 in assistance per household. By comparison, the average flood insurance claim provides nearly $30,000 to fund rebuilding and recovery. Substantially damaged properties may qualify for ICC (Increased Cost of Compliance) claims, which provide up to $30,000 to fund flood pro-tection measures such as elevation and floodproofing.

Property owners living behind FEMA-accredited levees do not face regulatory flood insurance requirements. However, these property owners should consider a Preferred Risk flood insurance policy, which provides the same level of protection against flood damage as Special Flood Hazard Area policies, but at a lower cost. For more information, visit this FEMA website.

In addition to flood insurance, property owners can take steps to reduce their physical vulnerability to flood risk. The most common of these measures are known as "FRED" - Floodproofing, Relocation, Elevation, and Demolition. For further information, visit the KDA-DWR Insurance and Mitigation Story Map. Simple steps such as elevating your HVAC equipment above the Base Flood Elevation and installing flood vents in enclosed areas can dramatically reduce the financial consequences of flood damage.

Left: Severe floods can cause levees to breach (courtesy Resilience Action Partners).

Right: Mitigation options for a home (courtesy Resilience Action Partners).

Want to learn more about levees? Here are a few interesting links from our partners at the U.S. Army Corps of Engineers "Silver Jackets" interagency risk reduction program.

Learn more about how USACE Silver Jackets helps promote levee safety in Kansas communities: https://silverjackets.nfrmp.us/State-Teams/Kansas/Levee-Safety-Work.

See an interactive map of levees in your area using the USACE National Levee Database https://levees.sec.usace.army.mil/.

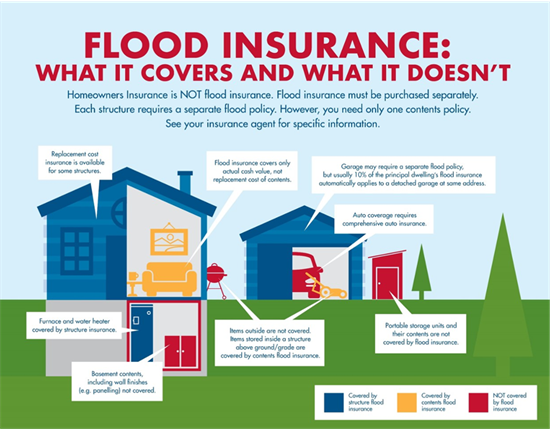

Did you know that standard homeowners and renters insurance policies rarely cover flood damage? Even if you’ve invested in such a policy, you could face an expensive surprise in the event of a flood. Be sure to give your home ’watertight’ protection by adding flood coverage to your insurance portfolio. Flood insurance policies typically take 30 days to go into effect, so don’t wait for a flash flood warning to get covered. For details on what a flood insurance policy can protect, check out the graphic below or visit FEMA’s Summary of Coverage. To learn more about obtaining a policy, contact your insurance agent or visit Floodsmart.

Above: Flood insurance covers many of the most valuable components of your home and its contents (courtesy Resilience Action Partners).